Your cart is currently empty!

China semi equipment sales break record

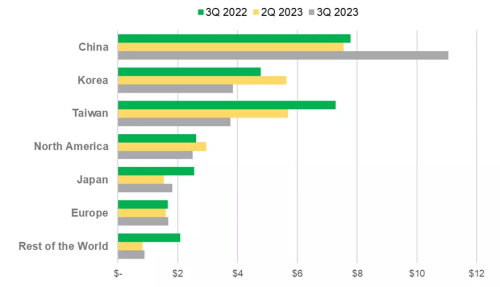

As global semiconductor manufacturing equipment sales contracted, China’s were booming in Q3, according to data published by Semi. Worldwide billings saw a drop of 11 percent, marking the biggest decline in four years, analysis from market researcher Trendforce shows. By contrast, sales in China increased 42 percent year-on-year, marking the first time that the Middle Kingdom’s share of global sales crossed the 40-percent threshold.

The data mirrors quarterly reports from major semiconductor equipment manufacturers. For example. ASML’s shipments to China made up 46 percent of total shipments in Q3 during weak overall market conditions. ASM managed to beat its revenue guidance thanks to an upsurge in China.

Many Chinese chipmakers were already focusing on mid-critical and mature semiconductors, demand for which is expected to surge as a result of the move to sustainable technologies, among other things. The implementation of US export controls last year also prompted Chinese firms to redirect their investments to more mature nodes.

Some fear the boom in China will cause a major capacity glut in the mature domain. As an estimated 32 new fabs will go online in China next year, Taiwanese foundries are bracing for a price war, Taiwan News reports. They’re already considering 10-percent price cuts ahead of “frozen” demand in the first quarter.